Table of Content

To accurately calculate your salary after tax, enter your gross wage and select any conditions which may apply to yourself. This is the amount deducted from your gross salary and paid into your pension pot. Income Tax and NI are not applied on this amount.The calculator lets you enter this as a percentage of your salary.

Whether a person is an employee or an independent contractor, a certain percentage of gross income will go towards FICA. In the case of employees, they pay half of it, and their employer pays the other half. Independent contractors or self-employed individuals pay the full amount because they are both employees and employers.

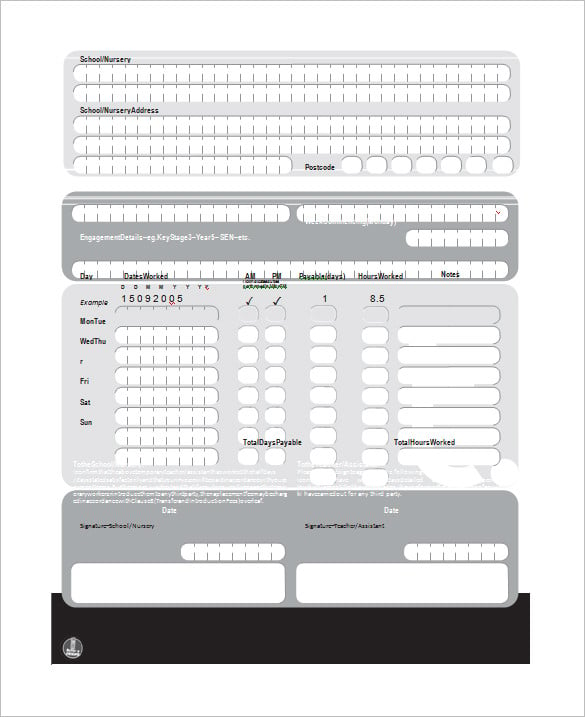

Working Hours per Day

The calculator lets you enter this as a percentage of your salary as employers usually pay this a percentage of your salary. Federal income tax is usually the largest tax deduction from gross pay on a paycheck. It is levied by the Internal Service Revenue in order to raise revenue for the U.S. federal government.

Exempt employees, otherwise known as salaried employees, generally do not receive overtime pay, even if they work over 40 hours. For more information about overtime, non-exempt or exempt employment, or to do calculations involving working hours, please visit the Time Card Calculator. Because taxes are complicated and vary greatly based on personal circumstances, we've made a few assumptions to make this salary calculator for the UK easy to use.

Pension Type

If you're interested in finding out more about your salary taxes, visit the HMRC website or contact your local tax office. SalaryBot will automatically check to see if you're being paid the minimum wage for your age group. If you find this calculator useful please share it with your friends using the below social media buttons. If you have more than one job, use the calculator once for each job. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year . In general, it is wise to stop contributing towards retirement when facing immediate financial difficulty.

You also have a National Insurance threshold of £166/week (or £8,632 a year), which means that you won't pay National Insurance if you are earning below this sum. You'll only pay National Insurance for the sum that youy are earning above that limit. The average UK salary in 2018 is £30,500 for men and £25,200 for women. The highest salaries in the UK are in the financial services and in the IT industry. London and Cambridge are the places where the highest average wages have been reported in 2018.

Hourly

The wage can be annual, monthly, weekly, daily, or hourly - just be sure to configure the calculator with the relevant frequency. This tells you your take-home pay if you do not have any other deductions, such as pension contributions or student loans. The federal income tax is a progressive tax, meaning it increases in accordance with the taxable amount. The more someone makes, the more their income will be taxed as a percentage. To find an estimated amount on a tax return instead, please use our Income Tax Calculator.

The easiest way to achieve a salary increase may be to simply ask for a raise, promotion, or bonus. If internal salary increases are not possible, which is common, try searching for another job. In the current job climate, the highest pay increases during a career generally happen while transitioning from one company to another. For more information about or to do calculations involving salary, please visit the Salary Calculator. You have a new job or got a raise and you want to know your salary net of tax? Assuming a 37.5-hour work week, the National Living Wage for a 23-year-old is £356 a week, £1,544 a month, or £18,525 a year.

Take Home Pay Calculator

You also have a national insurance threshold on your salary, which meant that you won't pay NI for the first £12,569 from your yearly salary. This means that, according to our calculations, only £32,431 of your yearly earnings will be liable for National Insurance. Accurate, fast and user friendly UK salary calculator, using official HMRC data. Calculate your monthly net pay based on your yearly gross income, with our salary calculator. To find out your take home pay, enter your gross wage into the calculator.

For instance, people often overestimate how much they are able to spend based on an inflated pre-tax income figure. Knowing the after-tax amount of a paycheck and using it to budget can help rectify this issue. For more comprehensive and detailed calculations regarding budgeting, try our Budget Calculator; just note that it also utilizes a before-tax input for income. Therefore, if we deduct the personal allowance from the yearly £45,000 salary, you'll have a taxable amount of £32,430.

As an aside, unlike the federal government, states often tax municipal bond interest from securities issued outside a certain state, and many allow a full or partial exemption for pension income. The Costrak salary calculator is intended to provide estimated salary figures and is not intended to be financial advice. You also have the option to get the figures for Annual, monthly, weekly and daily pay. To use the Take home pay salary calculator, you will be required to provide the following information.

Because contributions into an FSA are deducted from paychecks during payroll before income taxes, less income will be subject to taxation. The most common FSAs used are health savings accounts or health reimbursement accounts, but other types of FSAs exist for qualified expenses related to dependent care or adoption. For those who do not use itemized deductions, a standard deduction can be used. The standard deduction dollar amount is $12,950 for single households and $25,900 for married couples filing jointly for the tax year 2022. Taxpayers can choose either itemized deductions or the standard deduction, but usually choose whichever results in a higher deduction, and therefore lower tax payable. These calculations depend on your tax code, which your employer figures out based on your P45.

To more clearly illustrate what most individuals in the UK earn, we've compiled a before- and after-tax monthly earnings table with thirteen major cities. The starkest difference is between London's £2,548 monthly pay (£2,049 after-tax) and Leicester's £1,766 (£1,527 after-tax). Other major cities that break over the £2,000 before-tax threshold include Leeds, Glasgow, Southampton, Bristol, and Edinburgh.

Evasion of tax can result in serious repercussions such as a felony and imprisonment for up to five years. The median monthly pay in the UK is £2,113, or £25,356 yearly, according to the latest data from the Office for National Statistics and HMRC. The higher your income rises above this median pay level, the more comfortably you can expect to live across the UK. If we toss that median monthly pay into our UK salary calculator, it comes out to around £1,759 after-tax. Standard deductions to your take home pay include student loan repayments and pension contributions as a percentage.

This is also a form of salary sacrifice to save money on Tax and NI. It works like this, you decide how much you want to spend on the bicycle and related safety equipment, employer gives you a voucher for that amount. You take the voucher to the approved retailer and pick your bike and related safety equipment like helmet, lights, etc and pay with the voucher. Note that you don't own the bike, your employer owns it and you lease it, at the end of the lease period your employer usually sell it to the employee for a nominal amount.

No comments:

Post a Comment